Dymension: A New Paradigm for Cosmos and the Internet of Rollapps

Key Insights

- Dymension, a Cosmos appchain, is a settlement layer (anchor of a blockchain ecosystem) for Cosmos rollups called RollApps, intending to build the “Internet of RollApps” similar to Cosmos’ goal of developing the “Internet of blockchains”.

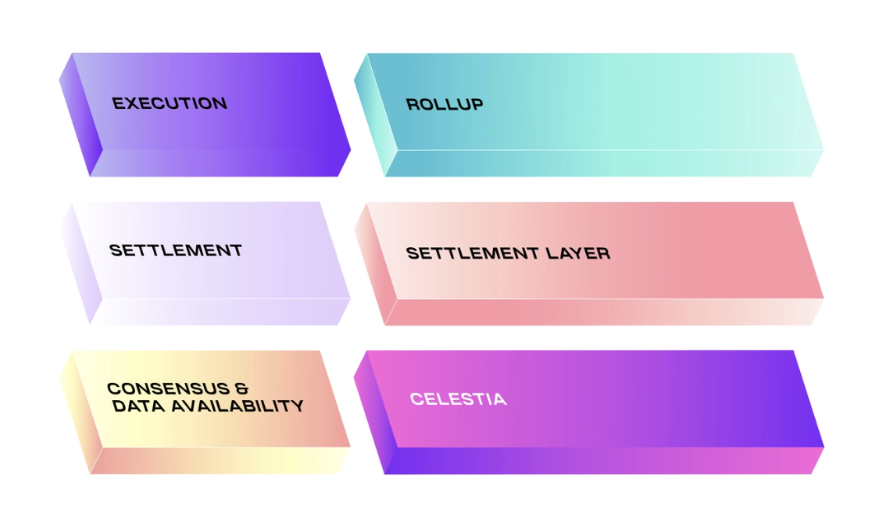

- Dymension is a modular blockchain that segregates consensus to its own chain, execution to RollApps, and data availability to DA layers such as Celestia.

- Dymension enables the deployment of enshrined optimistic rollups and plans to implement enshrined validity rollups in the future. Enshrined rollups boast important advantages over non-enshrined rollups including trust minimization, the avoidance of malicious governance attacks and multisig upgrades, and minimization of smart contract risk.

- RollApps deployed on Dymension realize multiple significant benefits relative to other scaling solutions: settlement layer security, optimal performance environment, access to liquidity, digital autonomy, and interoperability amongst other RollApps and all IBC-enabled chains.

What is Dymension

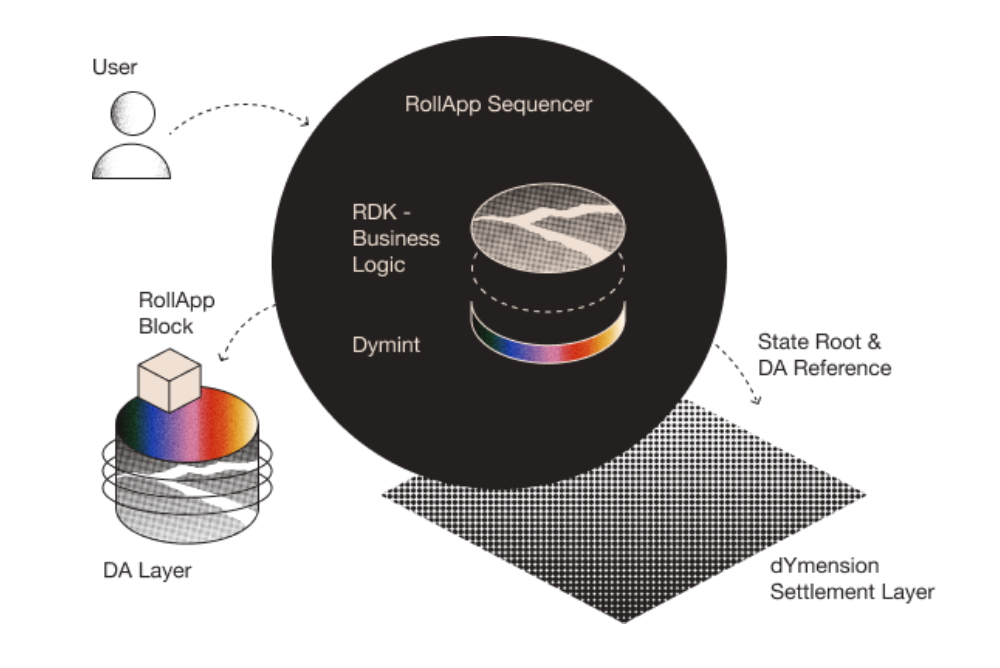

Dymension is a modular blockchain built for RollApps, or application-specific rollups. The protocol has two main functions: (1) acting as a settlement layer for RollApps and (2) providing a RollApp Development Kit (RDK), a pre-packaged set of generic modules that enable a simple process for building and deploying permission-less RollApps.

With RollApp logic embedded into the settlement layer (the Dymension Hub), Dymension enables enshrined rollups with robust security, interconnectivity, liquidity, and autonomy. Moreover, as RollApp consensus is outsourced to the settlement layer and instead relies on sequencers to batch transactions, RollApps can hyper-focus on execution in high throughput and low latency environments.

RollApps directly inherit security from Dymension’s settlement layer, which implements a fraud-proof mechanism to minimize trust in a RollApp sequencer. Sequencers are decentralized as an application on Dymension can be processed by multiple sequencers, who must bond DYM (Dymension’s native token) on the settlement layer for leader election. The RollApp Virtual machine handles fraud disputes by simulating the exact context and logic in which a disputed transaction was executed on a RollApp.

Liquidity in RollApps is achieved through an embedded native AMM within the settlement hub. RollApps also have complete autonomy over their tokenomics–– deciding what tokens network fees are paid in as well as having full control over their gas fee logic. In addition, RollApps can choose their own virtual machine (i.e. EVM vs. CosmWasm). Dymension’s modular design allows RollApps to dictate where to publish data between various data availability providers, including Celestia.

The Inter-RollApp Communication Protocol (IRC), a modified version of Cosmos’ IBC, allows for RollApp communication and Hub routing, with The Hub (the Dymension Hub) facilitating trust-minimized bridging amongst RollApps.

Dymension’s native ICS20 token, DYM, will facilitate IRC and IBC transactions, AMM RollApp swaps, and state root updates while also being bonded by sequencers.

The Dymension Hub (a Settlement Layer)

The Dymension Hub, known as The Hub for short, is a Cosmos SDK-based Proof-of-Stake blockchain utilizing the Tendermint Core to account for the networking and consensus layers of blockchain architecture. The Hub provides security, liquidity, and interoperability for RollApps deployed on top of the chain. By utilizing the Cosmos SDK, RollApps and the Dymension Hub are empowered with the ability to natively convey information across the ecosystem of all IBC-enabled chains. The Hub embeds within itself vital information for efficiently servicing RollApps, including a comprehensive registrar of Rollapps deployed on the protocol coupled with key corresponding information such as a Rollapp’s state and its sequencers. Dymension creates enshrined rollups by embedding RollApp logic natively within the settlement layer.

What Are RollApps?

RollApps are application-specific rollups. Rather than having to adhere to base layer protocol rules, RollApps retain autonomy over their own blockchain logic, including having their own native token and controlling its tokenomics. A RollApp executes transactions off-chain and may be operated by a single sequencer or a group of sequencers that take turns in transaction computation. Sequencers post batch and state roots to Dymension and the data availability layer designated by the RollApp.

Transaction lifecycle:

- Send transaction request to RollApp sequencer

- Sequencer processes transaction

- Sequencer batches a group of transactions into a block

- Sequencer publishes batch and state root data to the Dymension settlement layer and RollApp-designated DA layer

RollApp Architecture: Client and Server

- Server: Application side, with customizable business logic alongside the RDK

- Client: Batch production, peer message propagation, inter-layer communication functionality of the sequencer (uses dymint client, a replacement for Tendermint). Low latency since consensus tasks are not done in the RollApp itself and instead are outsourced to the Dymension Hub.

Building Enshrined Rollups

While the subject of enshrined rollups remains relatively new, there are important identifiable benefits that can be realized through enshrining rollups. Enshrined rollups, rollups serviced natively from the settlement layer, are built directly into Layer 1 instead of being deployed as a smart contract (as in the case of Ethereum rollups), eliminating risks of malicious protocol governance, mal-intended multisig upgrades, and any bugs within the smart contracts. In Dymension, rollup logic is embedded within the code of the settlement layer, equipping rollups with the same trust assumptions and level of security as the base layer while benefiting from a consensus-less overhead and a simpler work environment. One of the most important benefits of enshrining rollups is the minimization of trust assumptions rendered to rollup users, effectively increasing the security of their funds.

To better illustrate this, we will examine rollups deployed on Ethereum compared to those developed on Dymension. As mentioned previously, rollup logic is not incorporated into the Ethereum blockchain. Instead, rollups are secured to Layer 1 via smart contracts. Therefore, if a bridge hack were to occur, Ethereum would likely not revert the state of the chain to before the funds were at risk, because the hack affects only a specific rollup and does not directly impact the entire network. In the case of Dymension, this is different. If a given rollup is hacked, the Dymension chain is prompted into action, as the protocol itself has now been threatened, and validators within the network would collectively work to revert the state of the chain to when the funds were safe to avoid harm. An important drawback of this design is that rollups on Dymension have to agree to certain protocol rules, impacting their flexibility to a degree for the tradeoff of greater security.

At this point, it is important to note while enshrined rollups and smart contract rollups contrast each other, both could likely harmoniously coexist in the future with each rollup implementation playing an important role. However, the collaboration of enshrined rollups on Cosmos with smart contract rollups could introduce greater complexities and trust assumptions because of the differences in consensus structures between the two ecosystems.

Presently, RollApps being deployed on Dymension are enshrined optimistic rollups but Dymension has indicated intentions of implementing enshrined validity rollups (zk-rollups) in the future.

Optimistic RollApp Design

RollApps follow the model of optimistic rollups, which assume that sequencer state roots are the correct result of transaction execution unless challenged by a fraud-proof. A dispute period is installed for anyone to publish a fraud-proof on Dymension. If the RollApp’s state root is found to be fraudulent, the state is reverted to the previous state root, and the sequencer’s bonded DYM tokens will be slashed and partially rewarded to the fraud-proof publisher.

Dymension allows multiple sequencers to work for a RollApp. Dymension has a sequencer election mechanism to choose which sequencer will do transaction batching based on the relative amount of bonded DYM (Dymension’s native asset) on the settlement layer. Furthermore, RollApp deployers have the power to decide sequencer requirements and criteria.

Dymension’s Potential Use Cases

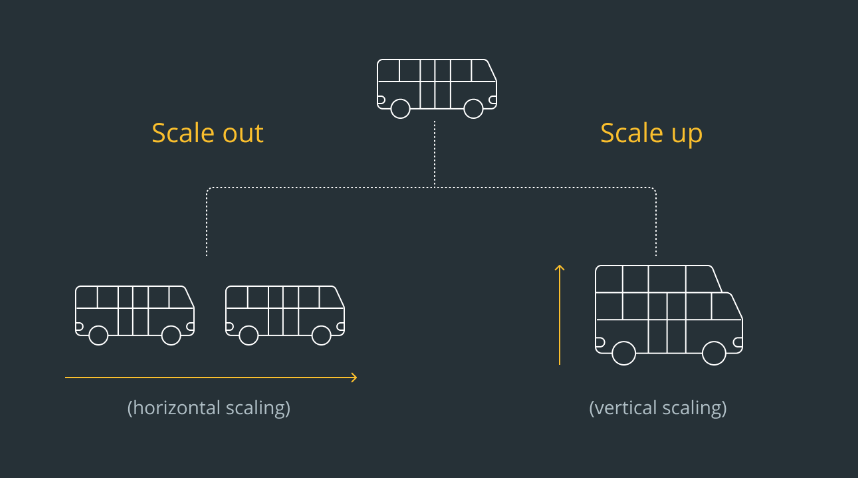

Vertically Scaling Cosmos

An immediate use case for Dymension would be to scale the Cosmos ecosystem. Historically known to scale horizontally, new appchains can continually be developed within the ecosystem. Dymension could help these appchains scale vertically – increasing overall throughput and decreasing latency. A given Cosmos appchain in need of more efficient scaling could merely deploy a RollApp on top of Dymension to achieve this goal. Therefore, a likely immediate use case for Dymension is to support the vertical scaling of the Cosmos ecosystem, enabling Cosmos zones (appchains) to further grow their communities and support greater use cases for their users.

GameFi and DeFi

GameFi and DeFi present additional strong potential use cases for the Dymension protocol. Applications falling under these sectors generally require low latency and high throughput activity, positioning Dymension as optimal infrastructure to develop customized rollups that meet specific requirements. Dymension provides critical features for thriving GameFi and DeFi environments by offering the security of a settlement hub, liquidity, high-performance, autonomy, and interoperability.

Dymension enables application developers to focus on building their product and outsourcing the provisions of a large validator set for consensus, token liquidity through Dymension's native AMM, RollApp interoperability and IBC connectivity, and low latency/high throughput. Axie Infinity’s significant Ronin hack highlighted the drawbacks within its mechanism design which enabled hackers to compromise the multisig bridge and withdraw funds. RollApps, however, will enable Web3 gaming experiences with ultra-low latency coupled with trust-minimized bridging that will allow for improved user experiences and greater application security.

Competing Scaling Solutions

What is the problem with current solutions?

Currently, many blockchains operate as shared bandwidth systems, limiting the potential growth of decentralized applications. While some rollups have made strides in increasing transaction speed and throughput, they are currently reliant on additional trust assumptions and make security tradeoffs.

In addition, inter-rollup communication is commonly expensive and lacks security. A cross-rollup protocol is necessary when multiple rollups are deployed on one blockchain. Ideally, a cross-rollup protocol would be implemented by native cross-rollup bridges maintained by the L1’s validators for security. Furthermore, the cross-rollup protocol would ideally support synchronous message calls from one rollup to another, which would allow a user on one rollup to directly call a function on another rollup. Trust-minimized cross-rollup interoperability solutions are beginning to emerge using zero-knowledge technology but they are still nascent.

Most current scaling solutions aim to minimize tradeoffs between security, inter-rollup communication, and transaction throughput. Others focus on simplifying validator bootstrapping but add additional work to existing validators while overall throughput remains limited by those validators’ hardware capabilities.

Competitors and Other Scaling Solutions

Celestia

Currently, Celestia's focus is on providing an L1 whose only job is to order transactions and ensure data availability for specialized blockchains to build on top of it. It does not have its own settlement layer, thus there exists a perfect synergy between Dymension and Celestia. While Celestia provides the bottom layer functionality of data availability within the modular blockchain stack, the Dymension hub takes care of proof verification, bridging facilitation, and liquidity within its settlement layer, leaving autonomy over the execution layer to trust minimized, light RollApps built on top of Dymension.

Polkadot

Polkadot’s focus is on building a multichain network where all chains deployed on the network can seamlessly interact and transact with each other. All application-specific parachains share their validator security with the central relay chain by default. Polkadot also provides its development framework, Substrate, for creating new blockchains, granting developers full control of the environment, storage, and economics of what’s built on top.

Polkadot’s drawback lies in its limited number of parachains––it is estimated to be able to support 100 parachains, with slots leased in auctions, making it difficult for smaller projects to secure their own parachain slots. In addition, though Polkadot’s interchain communication is robust, overall throughput and latency is not optimized and falls behind a modular stack architecture such as Dymension’s.

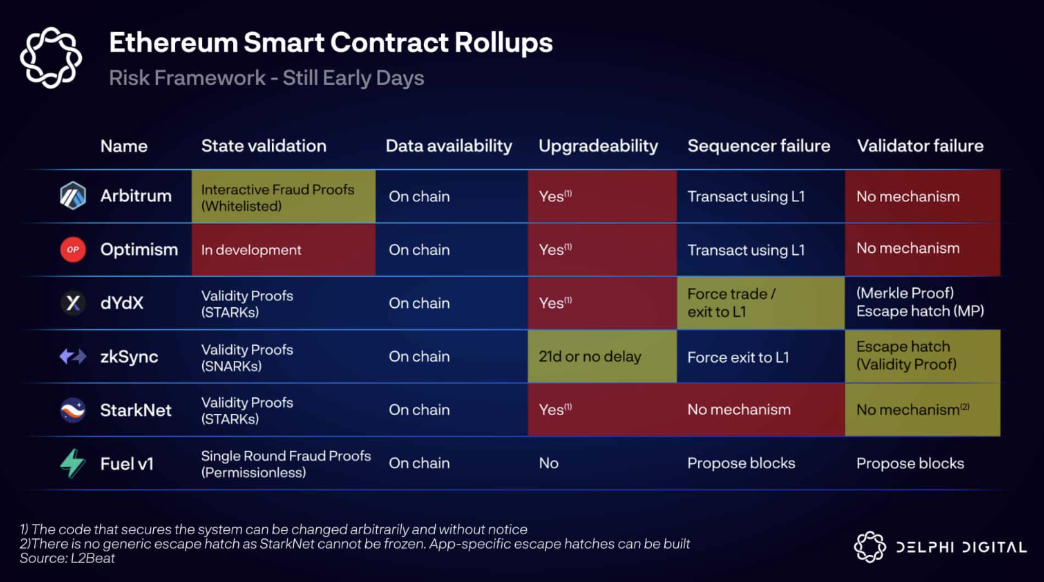

Ethereum Rollups

Layer two rollups on Ethereum, though promising in terms of scaling transaction speed and throughput, face significant security challenges. Most do not directly inherit security from Ethereum. In Optimism and Arbitrum, for example, not everyone can submit a fraud-proof yet. Only a select group of hand-picked operators can submit fraud proofs on Arbitrum, while Optimism’s fraud-proof system is not currently active, thus limiting the degree of decentralization in security.

Moreover, L2s are challenged by single-point-of-failure bridges and smart contract risk. Arbitrum and Optimism are “non-enshrined” rollups that exist on Ethereum as smart contracts. Acting essentially as multi-sig bridges, these smart contracts connect the base layer to rollups. As trust assumptions increase, so does the surface area for bugs and compromisation.

ZK rollups offer more robust security than optimistic rollups since their validity-proof-based system ensures that new states are always valid. However, ZK rollups are still susceptible to the risk of upgradability. For example, dYdX and StarkNet offer instant upgradeability, meaning that the code securing the system can be changed arbitrarily and without notice, while others implement an upgrade notice period. Consequently, a large amount of trust must be placed in the team. Greater decentralization in rollup governance is needed to guarantee trustlessness.

Further, there is limited composability and transaction flexibility between L2 protocols, leading to significant onboarding and offboarding friction. Users can transfer assets from one rollup to another rollup, but the process requires high fees, multiple transactions, and long withdrawal times. The fragmentation of dApps on different L2 chains also does the same for liquidity across Ethereum L1s and different scaling solutions.

Cosmos Interchain Security

Cosmos Interchain Security allows validators of the Cosmos Hub to validate other chains. Essentially, this allows for the reuse of the Cosmos Hub validator set and staked collateral to secure other Cosmos chains. This provides an increase in economic security with the upper bound of Cosmos Hub’s cost of corruption, gives consumer chains a faster validator network setup and path to market, and aligns consumer chains with Cosmos Hub and ATOM token.

While Interchain Security makes validator bootstrapping easier and increases the economic security for consumer chains, it does not scale the Cosmos network. Interchain security adds work to Cosmos Hub validators, and Cosmos’ overall throughput will still be limited to the hardware capabilities of the Cosmos Hub validators.

EigenLayer

EigenLayer will provide validators/computation as a service to any chain or middleware (oracles, bridges, sidechain). Ethereum validators re-stake their ETH into EigenLayer smart contracts to perform other duties to earn rewards while taking on more slashing risks on the same underlying ETH. This allows the bootstrapping of validator and trust networks for middleware applications like oracles and incentive alignment with Ethereum but is currently limited to the Ethereum ecosystem.

EigenLayer’s data availability layer, which asserts 15MB/s data transfer, can be a potential DA layer option for rollups, but communication with the DA layer will require more trust assumptions than using Celestia’s IBC-enabled DA layer.

RollApps on Dymension Present a Better Solution

RollApps are Dymension’s answer to the problem of finding an efficient scaling solution, allowing for higher throughput, lower latency, and a seamless deployment process for developers. RollApps built on the Dymension settlement hub receive multiple significant benefits or advantages as Dymension aims to provide the highest-quality service by offering the security of Dymension’s settlement layer, an environment for optimal performance, access to liquidity, digital autonomy, and more. Below is a list of major benefits received from deploying RollApps on Dymension:

1. Security

As RollApps built on Dymension are enshrined rollups (native RollApp logic is embedded within the settlement hub), they receive the same level of security as the settlement layer. Also, RollApps deployed on Dymension do not share the risks of utilizing bridges with many trust assumptions or smart contracts as these application-specific rollups are native to the Dymension L1.

2.Validator Network

Dymension eliminates the overhead of bootstrapping a validator network when spinning up new Cosmos chains. Moreover, it reduces the chain’s security budget and minimizes token dilution, as projects don’t need to incentivize validator node participation when chains are first launched. By curbing over-issuance, Dymension enables more robust tokenomics for its RollApps.

3. Optimal Performance Environment

RollApps outsource consensus to the settlement hub allowing them to focus solely on increasing throughput and reducing latency.

4. Access to Liquidity

Dymension has a natively embedded Automated Market Maker (AMM) providing RollApps with shared liquidity layered on shared security. Dymension will provide a market for RollApp tokens, which in turn will provide access to RollApp liquidity to the rest of the Cosmos ecosystem.

5. Digital Autonomy

One of the most intriguing advantages of Dymension is the digital autonomy it provides. Users pay network-related fees directly to RollApps (not Dymension) in their native token or any other token deemed acceptable by the specific RollApp’s business logic, supporting the sustainability of each RollApp by enabling more use cases and garnering greater value accrual for token holders.

6. Interoperability/ Inter-RollApp Communication

RollApps built on Dymension are equipped with Inter-RollApp Communication (IRC), allowing them to seamlessly communicate with other RollApps as well as all IBC-enabled chains. This attribute is particularly important as interchain communication (communication and data exchange among blockchain networks) has been one of the most important issues challenging blockchains today.

7. RollApp Development Kit (RDK)

Dymension created a custom-made RollApp Development Kit (RDK), forked from the Cosmos SDK, that allows developers to seamlessly deploy RollApps on top of the settlement layer. The RDK includes pre-packaged modules building off the SDK that break down the process of building and ultimately deploying RollApps on Dymension.

Why Cosmos

Building within the Cosmos ecosystem proved to be the most favorable decision for the Dymension team, offering a highly flexible blockchain tech stack to work with. The Cosmos network was developed with modularity in mind from the very beginning, enabling developers to readily chart new paths for the chain.

While it would have been possible for certain characteristics of Dymension to be developed on Ethereum, utilizing smart contracts to bridge application-specific rollups within the network, Dymension would have missed the opportunity to capitalize on key resources (such as Cosmos’ interoperable system via its IBC) and the flexible nature of developing in Cosmos.

Dymension aims to build the internet of RollApps and equip developers with a seamless building and deployment process to join the network. Ultimately, Cosmos provided the best design space for Dymension to achieve this goal.

Accruing Value Within the Cosmos

The Dymension protocol was built specifically for supporting and maintaining RollApps, and thus developers aiming to realize the benefits of RollApps on Dymension would need to develop directly on top of the protocol. Cosmos appchains can deploy RollApps on Dymension and reuse their own native token for RollApp network fees via utilizing Cosmos’ IBC protocol. This could encourage greater demand for a given Cosmos appchain’s token because developers could develop novel applications on Dymension in search of a protocol promising ultra-low latency. In this scenario, RollApp sequencers would pay fees to cover the following costs:

- Bonding DYM (Dymension’s native token) to ensure safety and security for users

- Fee to the network to update the state root

- Publication of data

Entering a New Paradigm, a New Dymension

Modular blockchains offer compelling advantages over strictly monolithic blockchains and have emerged as critical infrastructure for powering a multi-chain world. Within a modular architecture Dymension minimizes the workload handled by the execution layer by decoupling the settlement layer.

The Cosmos ecosystem has already become a home for many developers seeking autonomous but composable environments, becoming one of the most scalable and secure blockchain ecosystems. Dymension pushes the boundaries of scale for Cosmos by extending scale vertically. This is a natural path forward for Cosmos in parallel with other modular architecture developments such as Celestia’s data availability.

Dymension is a marriage and implementation of Ethereum’s rollup-centric vision that focuses on shared security and liquidity with Cosmos’ vision for greater connectivity, autonomy and SDK-based development. We are excited to be supporting the team and look forward to the ambitious roadmap of developments they are executing on.

Disclosure: Unless otherwise indicated, the views expressed in this post are solely those of the author(s) in their individual capacity and are not the views of Big Brain Holdings or its affiliates. Certain information contained herein may have been obtained from third-party sources, including from portfolio companies of funds managed by Big Brain Holdings. Big Brain Holdings believes that the information provided is reliable but has not independently verified the non-material information and makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in this blog are subject to change without notice and may differ or be contrary to opinions expressed by others.

The content is provided for informational purposes only, and should not be relied upon as the basis for an investment decision, and is not, and should not be assumed to be, complete. The contents herein are not to be construed as legal, business, or tax advice. You should consult your own advisors for those matters. References to any securities or digital assets are for illustrative purposes only, and do not constitute an investment recommendation or offer to provide investment advisory services. Any investments or portfolio companies mentioned, referred to, or described are not representative of all investments in vehicles managed by Big Brain Holdings, and there can be no assurance that the investments will be profitable or that other investments made in the future will have similar characteristics or results.

This blog does not constitute investment advice or an offer to sell or a solicitation of an offer to purchase any limited partner interests in any investment vehicle managed by Big Brain Holdings. An offer or solicitation of an investment in any Big Brain Holdings investment vehicle will only be made pursuant to an offering memorandum, limited partnership agreement and subscription documents, and only the information in such documents should be relied upon when making a decision to invest.

Past performance does not guarantee future results. There can be no guarantee that any Big Brain Holdings investment vehicle’s investment objectives will be achieved, and the investment results may vary substantially from year to year or even from month to month. As a result, an investor could lose all or a substantial amount of its investment. Investments or products referenced in this blog may not be suitable for you or any other party.